David S. Wolff Shares Predictions for Houston’s Commercial Real Estate Market Amid COVID-19 Pandemic

With 50 years of land development experience under his belt, David S. Wolff knows that disruptions also create opportunities. The current crisis, with the double whammy of the COVID-19 pandemic coupled with the energy industry downturn, is no different.

In a recent Bisnow webinar, Wolff shared his predictions of where Houston’s commercial real estate is heading and the company’s tried and tested strategies for remaining successful even in a downturn.

“We’re very careful when we buy land. We believe due diligence is something that you cannot overemphasize,” he said. Placing a premium on quality, Wolff Companies invests in properties with multiple exit strategies, where you can pivot to different land uses if market conditions suddenly change. Utilities, drainage, freeway access and the quality of local school districts are among many factors that determine the choice of a parcel.

For the past 50 years, Wolff Companies has been a developer of large master-planned, mixed-use business environments in the Houston area, including legacy projects such as Westway Park, Park 10 Regional Business Center and Beltway Business Park.

Addressing the economic recovery, Wolff acknowledged Houston’s dependence on the energy industry and lagging behind Austin in the tech sector. Speaking to Bisnow about Houston’s road to recovery, he emphasized the need for Houston to strengthen other revenue streams, diversify our employment base and do a better job of economic development to keep the city growing.

“We’re going to have to retrofit Houston for a new reality, because I don’t think fossil fuels are going to be what they were,” Wolff told Bisnow.

While some sectors of commercial real estate, such as office and retail, will suffer, there will be growth opportunities in other sectors, such as health care, multifamily, light industrial, manufacturing and warehousing.

The office market will suffer the most, with more and more companies potentially choosing to keep the remote work environment even after the pandemic. But Wolff sees an opportunity there too, predicting an increased demand for office space adapted for social distancing, with features that can protect and even improve the health of the workforce. Concurrently, he sees the need to consider working from home in the design stages of new multi-family projects, with flexible work spaces built into the common amenities mix and the individual units.

Retail is another sector facing increased challenges amidst this crisis, moving further from brick and mortar retail stores to online shopping.

On the positive side, Wolff said that Houston’s business-friendly climate, inexpensive housing, well-educated workforce, as well as the availability of large land parcels will provide ample opportunities for long-term recovery. As the COVID-19 pandemic continues to affect supply chains, Wolff predicts that U.S. companies are likely to have a long hard look at their supply chains and to reconsider their dependence on China and other Asian countries.

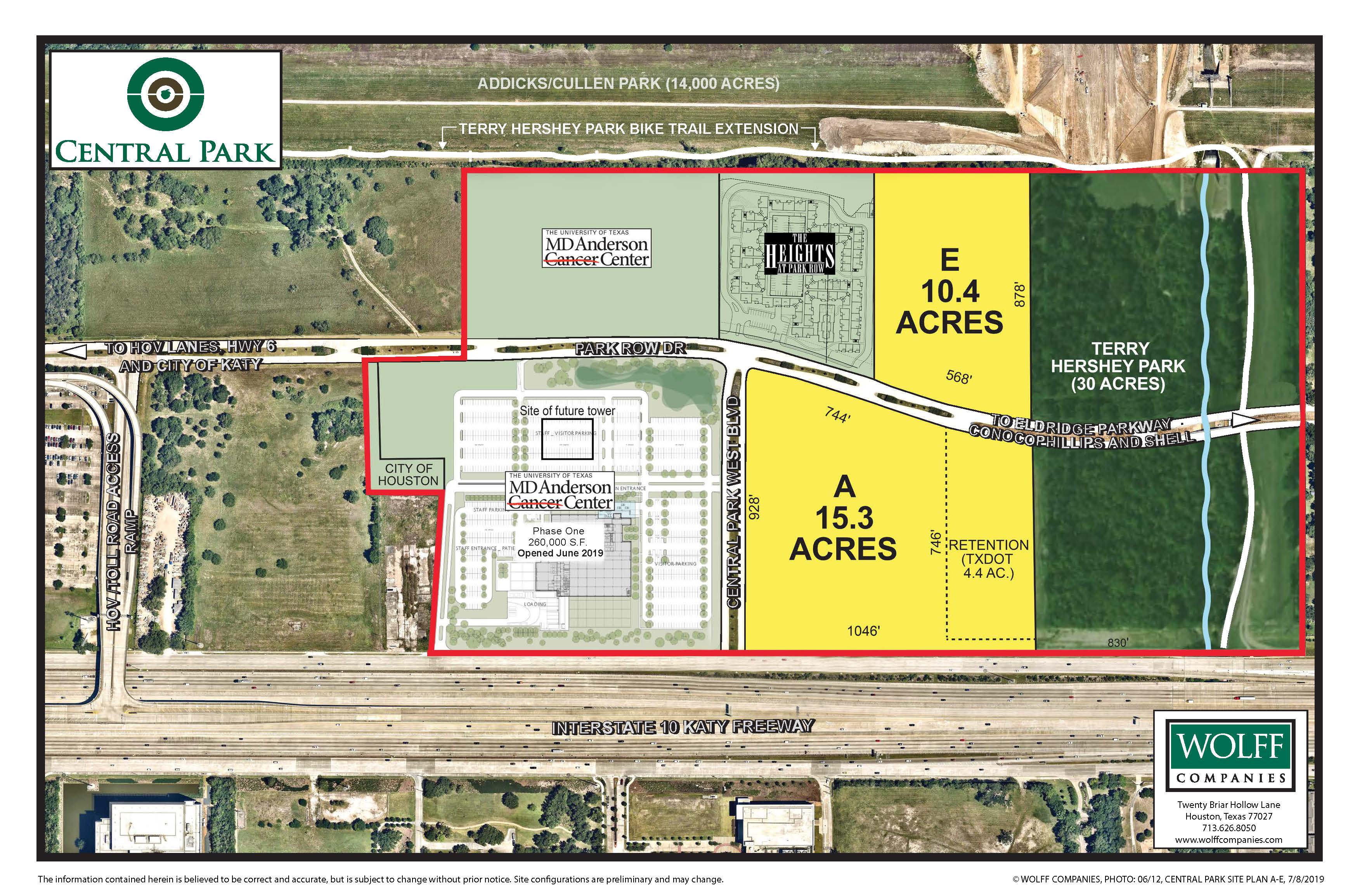

Two large tracts are still available in Central Park and are ideal for healthcare, hospitality, multi-family, hotel or retail development.

“I think you could see more manufacturing in the United Sates,” Wolff said. “One thing that has happened with this pandemic is that companies are realizing how vulnerable they are, sourcing from areas that might be difficult to access during a crisis.”

Wolff points out that Houston is becoming a center for manufacturing and distribution and that the COVID-19 crisis will further drive significant ‘on-shoring’ of these sectors, which will benefit Houston.

And the good news does not end there. The commercial real estate industry is much better positioned for the long-term survival than it was in the 80s, with many more properties in the hands of well-capitalized, professional developers who can take the long-term view. Speaking to the Houston Chronicle, Wolff noted that lenders now take a more conservative approach, requiring investors and developers to put more of their own money into a deal.

Operating without debt has served the Wolff Companies well over the decades. The company not only finances all of its deals, but also maintains lean operations by outsourcing its overhead costs for functions such as legal, engineering and public relations.

Wolff views the current economic climate as “a good, albeit painful, experience” for the younger generation of commercial real estate pros, who haven’t experienced previous crises. There are fewer lessons to be learned in a good market, he says, but a downturn provides opportunities to be more disciplined and focused. He encourages younger generations to use the downtime to figure out what business to focus on and become an expert in it.

“I believe that younger people thrive in change, and they have the needed energy and perseverance to succeed,” he says. “My advice to them is to focus and become an expert in a particular area where they think there will be opportunities when the market bounces back.”